All Categories

Featured

Table of Contents

The disadvantages of infinite banking are commonly neglected or otherwise stated in any way (much of the info readily available regarding this principle is from insurance policy agents, which may be a little prejudiced). Only the cash money worth is growing at the reward rate. You additionally need to pay for the cost of insurance coverage, fees, and expenses.

Firms that offer non-direct acknowledgment financings might have a lower reward price. Your money is locked right into a complicated insurance coverage item, and abandonment charges generally do not disappear up until you've had the plan for 10 to 15 years. Every permanent life insurance plan is different, however it's clear somebody's total return on every dollar spent on an insurance coverage item can not be anywhere close to the reward rate for the policy.

Infinite Concept

To offer an extremely standard and theoretical example, allow's think a person is able to make 3%, usually, for every dollar they spend on an "infinite financial" insurance product (nevertheless expenditures and charges). This is double the approximated return of whole life insurance policy from Consumer Information of 1.5%. If we think those bucks would undergo 50% in taxes complete otherwise in the insurance coverage product, the tax-adjusted rate of return can be 4.5%.

We think greater than typical returns overall life item and a very high tax price on bucks not take into the plan (which makes the insurance coverage item look better). The truth for many people might be worse. This fades in comparison to the long-lasting return of the S&P 500 of over 10%.

Boundless banking is a wonderful product for representatives that market insurance, yet might not be optimal when contrasted to the more affordable options (without any sales individuals making fat compensations). Here's a malfunction of some of the other purported benefits of infinite financial and why they may not be all they're cracked up to be.

Cash Flow Banking With Life Insurance

At the end of the day you are getting an insurance coverage product. We love the security that insurance coverage uses, which can be gotten much less expensively from an affordable term life insurance plan. Unsettled finances from the policy might also decrease your survivor benefit, lessening one more degree of defense in the policy.

The principle just works when you not just pay the considerable costs, but utilize additional cash money to buy paid-up additions. The possibility cost of all of those dollars is remarkable exceptionally so when you could rather be investing in a Roth IRA, HSA, or 401(k). Even when contrasted to a taxable financial investment account and even a financial savings account, limitless banking might not provide equivalent returns (contrasted to spending) and comparable liquidity, gain access to, and low/no charge framework (compared to a high-yield financial savings account).

With the rise of TikTok as an information-sharing system, monetary suggestions and methods have actually found an unique method of dispersing. One such method that has been making the rounds is the limitless financial principle, or IBC for short, amassing endorsements from stars like rapper Waka Flocka Fire. Nevertheless, while the approach is currently preferred, its origins trace back to the 1980s when financial expert Nelson Nash introduced it to the world.

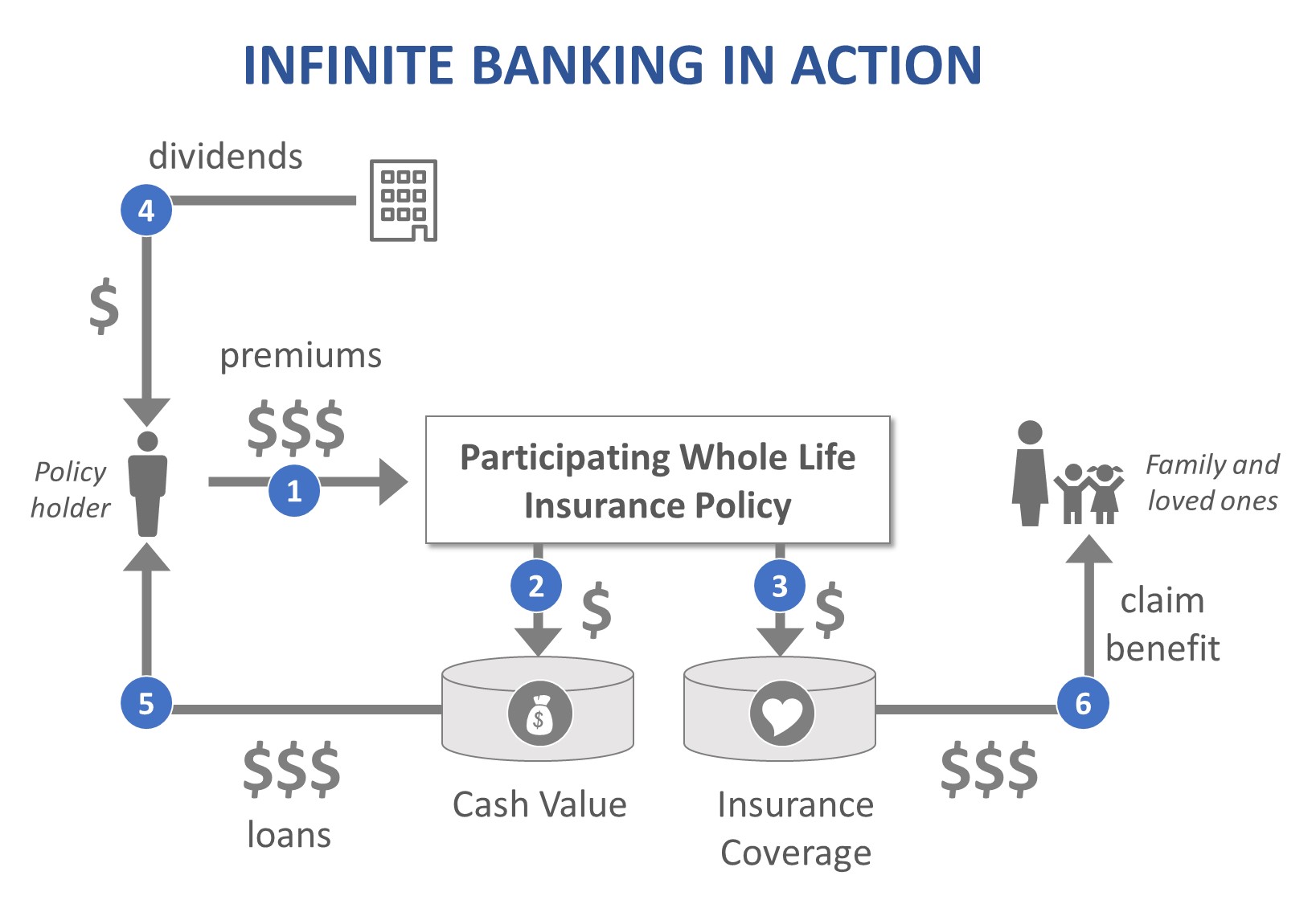

Within these policies, the money worth grows based upon a price established by the insurance provider. When a significant cash value accumulates, insurance holders can obtain a money worth loan. These lendings vary from traditional ones, with life insurance policy working as security, implying one might shed their insurance coverage if borrowing excessively without ample cash worth to support the insurance policy costs.

Cash Flow Banking Insurance

And while the appeal of these plans appears, there are natural restrictions and risks, demanding attentive cash money worth tracking. The approach's legitimacy isn't black and white. For high-net-worth individuals or company owner, particularly those using approaches like company-owned life insurance policy (COLI), the benefits of tax breaks and substance growth could be appealing.

The appeal of boundless financial doesn't negate its challenges: Cost: The fundamental requirement, a permanent life insurance policy plan, is more expensive than its term counterparts. Qualification: Not everybody certifies for whole life insurance policy as a result of rigorous underwriting procedures that can leave out those with details health and wellness or way of living problems. Intricacy and threat: The detailed nature of IBC, coupled with its threats, may deter many, especially when less complex and less risky alternatives are offered.

Assigning around 10% of your regular monthly earnings to the policy is simply not practical for many people. Component of what you check out below is simply a reiteration of what has already been said over.

So prior to you get on your own into a circumstance you're not gotten ready for, recognize the complying with initially: Although the principle is typically sold therefore, you're not actually taking a funding from yourself - what is infinite banking. If that were the situation, you would not need to settle it. Instead, you're borrowing from the insurance provider and need to settle it with interest

Bioshock Infinite Vox Code Bank

Some social networks posts advise utilizing cash money worth from whole life insurance policy to pay down credit score card financial obligation. The concept is that when you pay back the finance with passion, the quantity will be returned to your investments. Regrettably, that's not exactly how it functions. When you repay the lending, a portion of that passion mosts likely to the insurance business.

For the first numerous years, you'll be paying off the compensation. This makes it incredibly challenging for your plan to accumulate value throughout this time. Unless you can pay for to pay a few to a number of hundred dollars for the following decade or even more, IBC won't work for you.

If you call for life insurance, right here are some useful ideas to consider: Consider term life insurance policy. Make sure to go shopping about for the ideal price.

Boundless banking is not a services or product provided by a particular organization. Limitless financial is an approach in which you acquire a life insurance policy policy that gathers interest-earning cash money worth and obtain fundings against it, "borrowing from on your own" as a resource of funding. Then at some point pay back the loan and begin the cycle throughout once again.

Pay policy premiums, a portion of which constructs money worth. Take a funding out against the policy's cash worth, tax-free. If you use this idea as planned, you're taking cash out of your life insurance coverage policy to buy every little thing you would certainly require for the remainder of your life.

Latest Posts

Infinite Banking Concept Updated For 2025

Infinite Concept

Be Your Own Bank Life Insurance